Zillow Just Made Homes Look Safer — But Are They?

Dec 06, 2025 · news

In a move stirring quiet debate across the real-estate world, Zillow has removed its on-page climate-risk scores—the flood, wildfire, and extreme-heat indicators many buyers relied on while browsing listings. Instead of providing risk levels directly, Zillow now pushes users to external sources if they want more detail.

At first glance, this may look like a minor UI tweak. But beneath the surface lies a larger tension: Should climate-risk visibility be a core part of the home-shopping experience? Or does placing risk data front-and-center create unfair pressure on certain regions and sellers?

Why Zillow Stepped Back From Climate Transparency

Agents and sellers have long argued that prominent climate-risk labels—especially those marked “High Flood Risk” or “High Wildfire Risk”—discouraged buyers too early in the process. Even homes with little historical exposure received alarming designations due to broad predictive models.

Faced with industry pressure, Zillow made a decision many platforms quietly consider: remove the risk indicator from the main listing screen and let buyers find the data on their own.

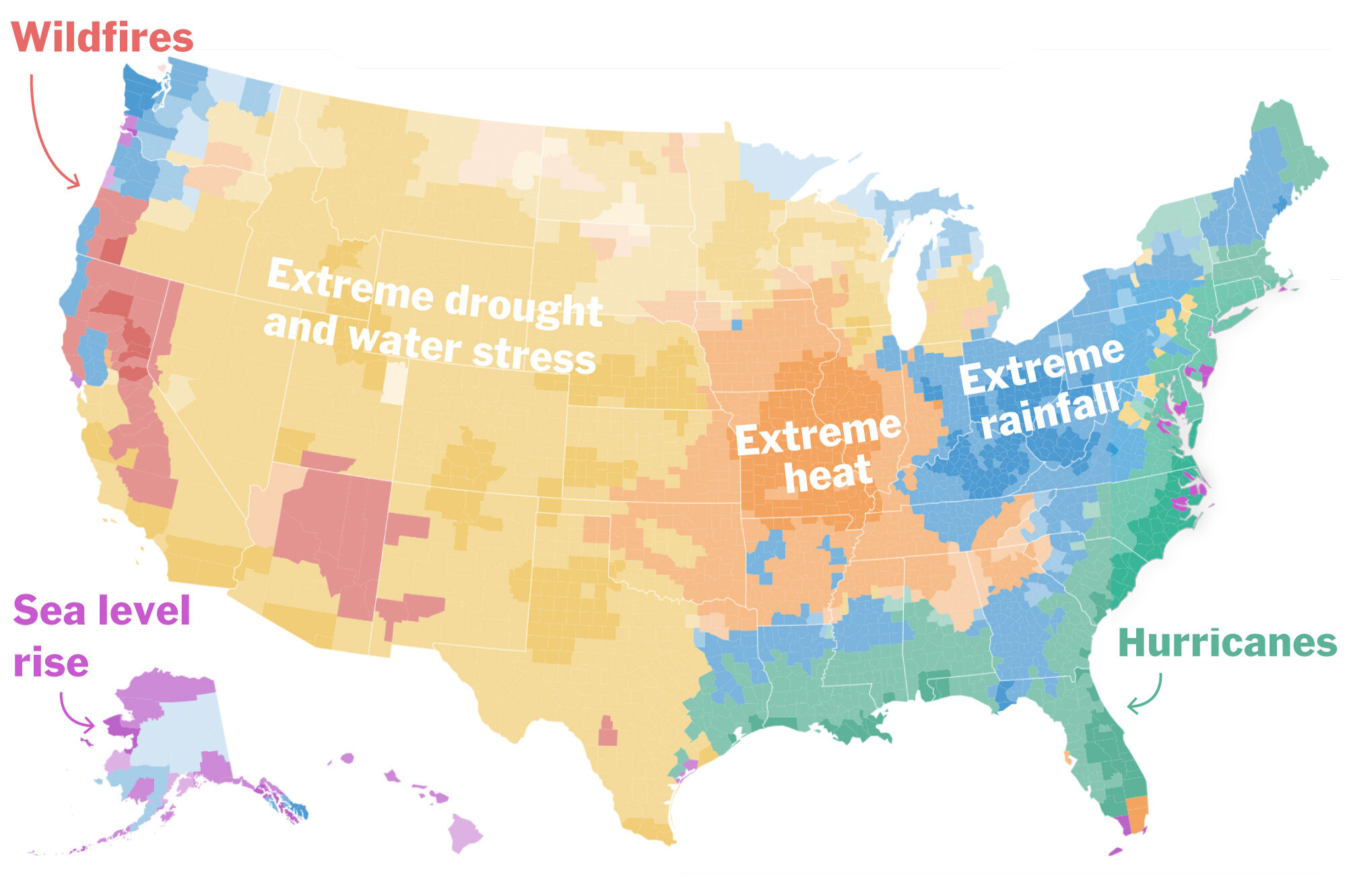

But ignoring risk doesn’t eliminate risk. Climate exposure still affects insurance, financing, resale value, and long-term livability—even if it’s no longer displayed at the top of a listing.

Buyers Still Need Climate Data—Because Insurers Demand It

While Zillow may downplay climate indicators, insurance companies continue moving in the opposite direction. In high-risk regions such as Florida, Louisiana, and California, climate exposure already influences:

- Insurance availability and premiums

- Loan underwriting requirements

- Mitigation mandates (roofing, elevation, materials)

- Approval timelines and documentation

A buyer unfamiliar with these factors may enter a transaction unaware of the true cost of ownership. Zillow’s removal of risk scoring shifts the responsibility onto the consumer—many of whom don’t know where to look for accurate climate data.

Where Climate Transparency Is Moving Next

Zillow’s decision reflects a broader industry trend: large listing platforms may avoid climate-risk scoring altogether to reduce controversy or market impact. As a result, climate data is decentralizing and shifting toward third-party tools.

Platforms such as FEMA, First Street Foundation, and various environmental datasets offer transparency—but often in fragmented, highly technical formats. That’s where newer neighborhood-level analytics tools are stepping in.

Acrelytic, for example, continues to include climate indicators inside its Neighborhood Snapshot. Rather than removing risk scores, Acrelytic presents climate data alongside demographics, affordability, crime, walkability, school quality, and air quality—allowing buyers to understand risk as part of a larger neighborhood profile.

When climate insights are contextual—not hidden—buyers make better decisions, and sellers can present their neighborhood’s full story rather than a single risk score.

Actionable Tips for Buyers Navigating This New Landscape

If climate indicators won’t appear on listing pages anymore, buyers should take a more proactive approach:

- Use third-party climate tools (e.g., First Street Foundation, FEMA Flood Maps).

- Review insurance quotes early—don’t wait until you’re under contract.

- Ask sellers about historical weather events or mitigation upgrades.

- Use neighborhood-level reports like Acrelytic’s Snapshot to see climate data in context.

Zillow may have removed on-page climate-risk scores, but climate risk remains a defining force in American real estate. As transparency shifts away from listing platforms, buyers and investors will increasingly rely on independent tools that surface the data clearly—and honestly.